- 5015 Airpark Drive, San Antonio, TX 78237

- |Contact Us

Insulation Tax Credits for Your San Antonio Home

Installed Building Products San Antonio is a trusted partner in home insulation solutions.

To get started, call 210-764-4602 to learn more about insulation installation and tax rebates.

Benefits of Adding New Home Insulation

When it comes to making your home more energy-efficient, retrofit insulation (adding new insulation to your home) is a smart choice and a wise investment for your home. It makes your home eligible for the coveted tax credits and offers other benefits you can enjoy for years to come.

By choosing to retrofit your home with new insulation, you can:

Lower Energy Bills

Insufficient insulation in your home can lead to energy leaks, causing your HVAC system to work harder to maintain a comfortable indoor temperature. Upgrading your insulation can significantly reduce these leaks, leading to lower energy consumption and, in turn, reduced energy bills.

Extend the Life of Your HVAC System

When your HVAC system doesn’t have to strain to compensate for heat loss or gain, it operates more efficiently and experiences less wear and tear. Proper insulation helps prolong the life of your heating and cooling equipment, saving you from costly repairs or premature replacements.

Enhance Home Comfort

Consistent indoor temperatures throughout your home ensure a comfortable living environment year-round. With improved insulation, you can say goodbye to chilly drafts in the winter and hot spots in the summer, creating a cozy and enjoyable space for your family.

Boost Home Value

Investing in energy-efficient upgrades like insulation not only benefits your wallet through lower utility bills but can also increase your home’s market value. Homebuyers increasingly seek energy-efficient homes, making insulation upgrades an attractive selling point.

Call 210-764-4602 to learn more about the benefits of retrofit insulation and how it improves the value and efficiency of your home.

Contact IBP San Antonio Today

IBP San Antonio helps homeowners make their living spaces more energy-efficient and comfortable. Our experts will guide you through the insulation options best suited for your home and ensure a seamless and efficient installation process.

Call us today at 210-764-4602 to make your plans to upgrade your insulation.

Fiberglass insulation is a durable, energy-efficient solution that helps regulate indoor temperatures, reduce noise, and improve overall comfort in homes and businesses.

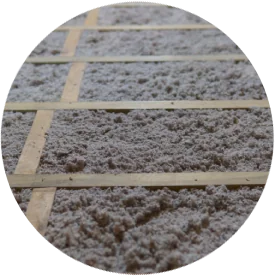

Cellulose insulation is an eco-friendly, highly effective material made from recycled fibers that enhances thermal performance and helps reduce energy costs in homes and businesses.

Spray foam insulation is a high-performance solution that expands to fill gaps, creating an airtight seal for superior energy efficiency, moisture control, and soundproofing in homes and commercial spaces.

Radiant barrier is a reflective insulation solution that reduces heat transfer, helping to keep homes and commercial spaces cooler, more energy-efficient, and comfortable.

A fireplace is a stylish and functional centerpiece that adds warmth, ambiance, and comfort to homes and commercial spaces, enhancing both aesthetic appeal and energy efficiency.

Window coverings provide privacy, light control, and energy efficiency while enhancing the style and functionality of homes and commercial spaces.

Gutters are essential for directing rainwater away from your home or commercial property, protecting the foundation, preventing water damage, and improving overall drainage efficiency.